A Consumer's Guide to the Texas SR-22 - Part 2

Should I Tell My Insurance Company About The SR-22?

This question requires us to look at a couple of factors in order to be answered properly. You see, even though the Texas Department of Public Safety regularly advises people to obtain the SR-22 form from their automobile insurance provider; that is not always possible. Many insurance carriers consider the SR-22 to be an indicator of a “sub-standard” or “high-risk” driver; so if a driver who is already insured with the company requests an SR-22, this sends up warning flags to the company underwriters. An insurance company is required to file its underwriting guideline with the Texas Department of Insurance; and then it must follow that guideline for all clients or face penalties. If the company you are currently insured with provides coverage for “sub-standard” or “high-risk” drivers (people with multiple tickets or accidents on their driving record), then the best advice is to talk to your current insurance agent about obtaining the SR-22.

However, if your current automobile insurance carrier is one of those companies that specialize in providing coverage for “standard” or “preferred” drivers, then obtaining the SR-22 from your current company can become much more difficult. Here are some of the potential problems to be aware of:

- If your company does not want to issue the SR-22 and you try to force the issue, your policy will usually be flagged for non-renewal. In addition, it is important to understand that many times the underwriters will use delaying tactics (an example would be requests for additional information or documentation) before issuing the SR-22. Many times the policyholder will be under a strict timeline to provide the SR-22 and these delaying tactics will force the client to either voluntarily cancel their coverage or go somewhere else to obtain the SR-22.

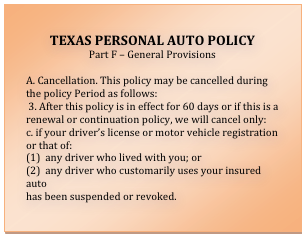

- Another reason for the delaying tactic is this… once a policy has been in effect for 60 days, an insurance company can only cancel the policy for very specific reasons which are outlined in the Texas Personal Auto Policy (see text insert for exact wording). This is especially important if the SR-22 is being required to obtain an Occupational or Essential Needs License (ODL). Although the ODL is a valid driver’s license, during the period of time it is required the license status at DPS will show “Suspended”. This allows the insurance company the opportunity to cancel the policy with a written 10 day notice to the policy’s Named Insured at the address shown on the policy’s Declaration Page. So by simply employing these delaying tactics in the issuance of the SR-22, many times the company can entirely avoid issuing the form completely.

- Sometimes an insurance carrier might have several different tiers of companies available in which to place the coverage. These tiers might range from a Preferred Rate company to a Sub-Standard Rate company where the SR-22 could be issued. The agent might offer to move the insured’s policy to the Sub-Standard company in order to provide the SR-22, however this move is often quite harmful to the policyholder. You see, this move affects all drivers and vehicles on the policy, so suddenly the entire family is stuck paying these higher Sub-Standard rates. Even after the need for the SR-22 has passed, many times it takes years before the family is again eligible for a Preferred rate.

- Your agent might offer to separate the driver who needs the SR-22 from the family policy and place coverage for that driver and vehicle through a Sub-Standard carrier that can provide the SR-22. This can present a problem because this driver would have to be excluded from the family’s auto policy… that means that if the excluded driver were to drive any of the family’s other vehicles, there would be no coverage. Another problem with this idea arises if there are only two vehicles on the family policy. Many insurance companies offer substantial multi-car policy discounts, so the single car left on the family policy is likely to see a large premium increase at renewal. Additionally, it often takes years before the excluded driver is again eligible for a Preferred rate.

- Finally, the need for an SR-22 can affect policies other than a family’s auto insurance. Many carriers offer very substantial multi-line policy discounts. For example, if your insurance carrier provides coverage for both your home and automobiles you might be receiving a large discount in the premium on both of those policies. If you are forced to move your auto coverage to a different company that can provide an SR-22; not only will you see an increase in the amount of money you are paying for your auto policy, but upon renewal you will probably see a huge increase in your homeowner’s insurance because it no longer qualifies for the multi-line discount. Since homeowner’s insurance is often the most expensive policy a family purchases, this increase can be quite substantial.

In conclusion, if you currently have your insurance coverage through a “sub-standard” or “high-risk” company you should talk to your agent about providing the SR-22. If however you are currently insured through a “standard” or “preferred” company, then you should look at some other options before contacting your insurance. I will be discussing these options available to you in the next part of this series.

Part 1 | Part 2 | Part 3 | Part 4 | Part 5

Jay Freeman is the owner of ConceptSR22.com, a website specialized in solving Texas SR-22 problems. If you need assistance in obtaining a Texas SR-22 or have questions not addressed in this series, please contact his office from the website. Thank you for reading this series..

© Jay Freeman – This article may be copied and distributed with original attribution and permission of author.

Accurate Concept Insurance

972-386-4386 ~ 800-967-4386

Serving Texas since 1993